In the world of finance, credit scoring plays a crucial role in determining an individual’s creditworthiness. Traditionally, credit scoring models have relied on statistical methods and predefined rules to analyze a borrower’s credit history, income, and other financial data. However, with the advent of artificial intelligence (AI) and machine learning (ML), the credit scoring landscape is undergoing a significant transformation.

AI and ML algorithms have the ability to process vast amounts of data, identify complex patterns, and make predictions with remarkable accuracy. By leveraging these advanced technologies, lenders can gain deeper insights into a borrower’s financial behavior, enabling more informed and fair credit decisions.

Here are some ways AI is revolutionizing credit scoring:

- Alternative Data Sources: AI models can incorporate a wide range of alternative data sources beyond traditional credit reports. This includes data from social media, utility bills, rental payments, and even psychometric data. By analyzing these diverse data points, AI can paint a more comprehensive picture of an individual’s financial situation and creditworthiness.

- Predictive Analytics: Traditional credit scoring models rely on historical data to make predictions about future behavior. AI, on the other hand, can leverage predictive analytics to forecast a borrower’s likelihood of defaulting or making timely payments. This proactive approach allows lenders to mitigate risks and make more informed lending decisions.

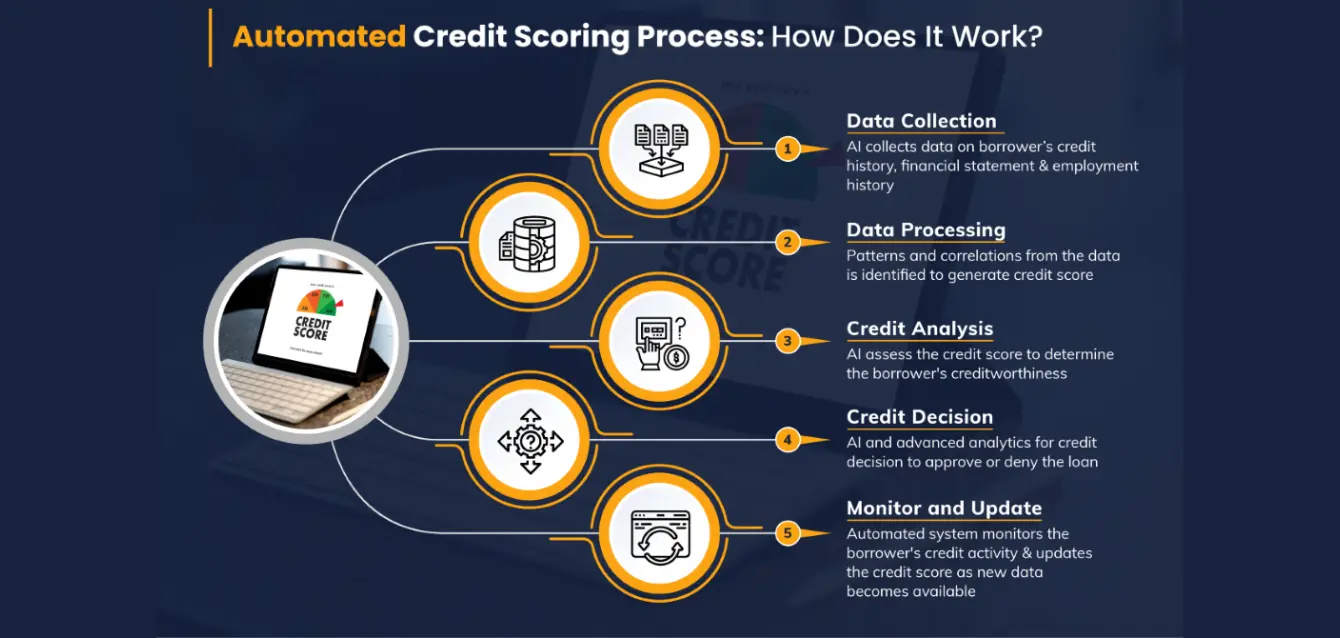

- Automated Decision-Making: AI-powered credit scoring systems can automate the decision-making process, reducing the time and effort required for manual reviews. This not only streamlines the lending process but also minimizes human bias and ensures consistent decision-making across all applicants.

- Continuous Learning: Unlike traditional models that require periodic updates, AI systems can continuously learn and adapt to changing market conditions, consumer behaviors, and regulatory environments. This dynamic nature ensures that credit scoring models remain relevant and accurate over time.

- Explainable AI: While AI models can be complex, advancements in explainable AI (XAI) techniques allow lenders to understand the reasoning behind credit decisions. This transparency not only builds trust with borrowers but also helps lenders comply with fair lending regulations.

Despite the numerous benefits, the adoption of AI in credit scoring is not without challenges. Concerns around data privacy, algorithmic bias, and regulatory compliance must be addressed to ensure responsible and ethical use of these technologies.

As the financial industry continues to embrace digital transformation, the integration of AI in credit scoring is poised to become the norm. By leveraging the power of AI, lenders can make more informed decisions, expand access to credit for underserved populations, and ultimately foster a more inclusive and efficient lending ecosystem